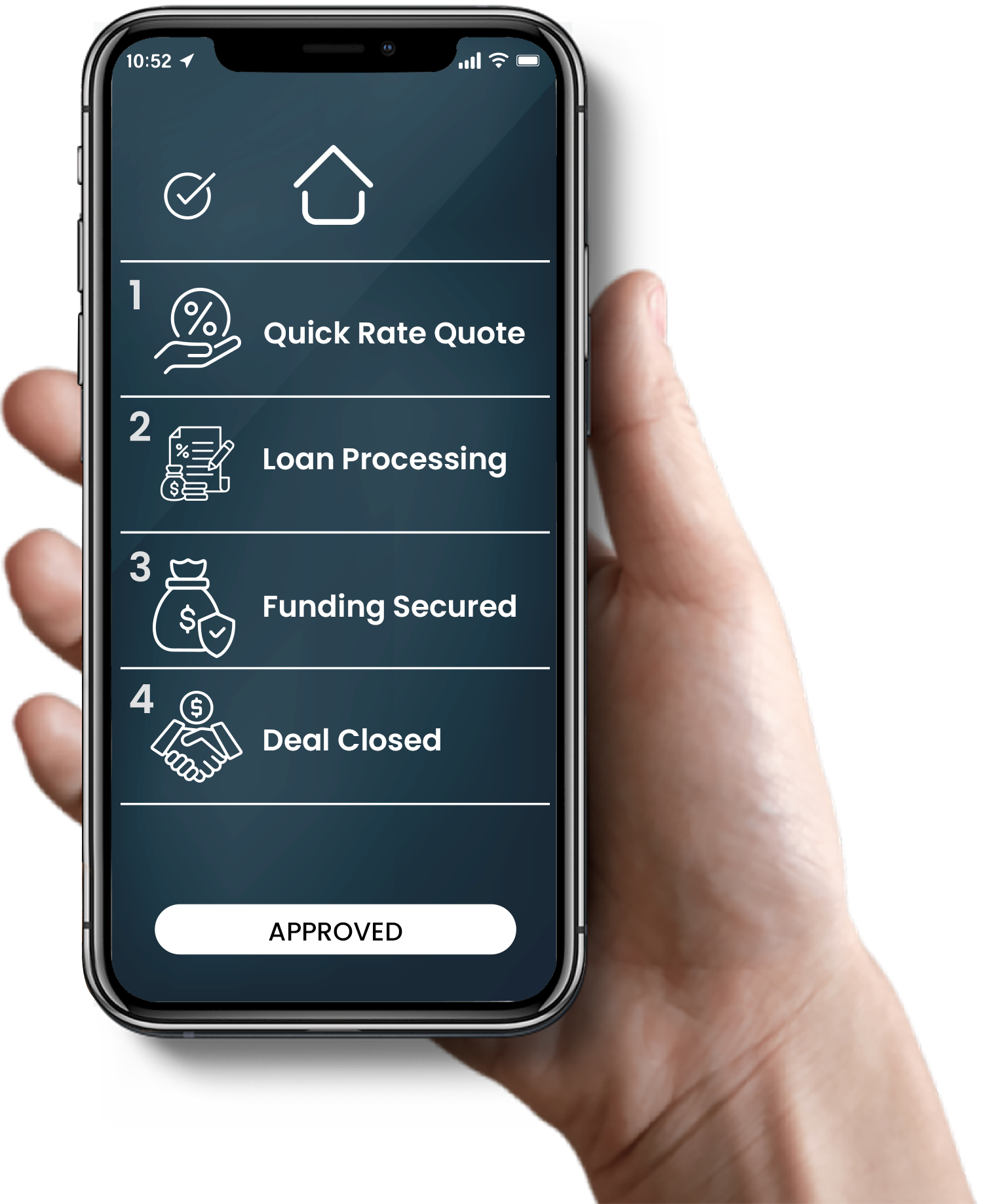

Refinancing

Made Simple

Close Fast

Access flexible loan terms with minimum down payments as low as 3%. Enjoy industry-low rates, making homeownership more affordable than ever.

high leverage

Take advantage of government-backed loans with low down payment options and competitive terms designed for first-time buyers or eligible veterans.

competitive rates

Secure financing for high-value properties in California with loan amounts exceeding conforming limits, reduced costs, and fast, hassle-free closings.

” Lorem Ipsum has been the industry’s standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

How Much Can I Save by Refinancing my Mortgage?

Have questions about refinancing your mortgage? Below are answers to some of the most common questions.

How can refinancing your home mortgage save you money?

Refinancing can lower your monthly payments by securing a reduced interest rate or adjusting the term of your mortgage loan. You may also save on total interest costs over the life of the loan or pay off your mortgage faster with a shorter term. Tools like our mortgage calculator can help estimate potential savings, making it easier to decide if refinancing aligns with your financial goals.

Can I refinance my mortgage loan with bad credit?

Yes, it’s possible to refinance a mortgage loan with bad credit. Government-backed programs, such as an FHA streamline refinance, can be a good choice if you already have an FHA loan. Alternatively, some lenders may allow refinancing with a co-signer or higher interest rates. Improving your credit score before refinancing can help you secure better terms and a lower interest rate. The first step is to give us a call. We’ll perform a soft credit inquiry, which won’t affect your credit score, to determine which loan programs you qualify for.

What are the costs involved in refinancing a mortgage loan?

Refinancing typically involves closing costs, which include appraisal fees, title insurance, lender fees, and other administrative costs. These expenses usually range from 1-4% of your loan amount. Some lenders offer a no-closing-cost refinancing option, where costs are rolled into your loan or exchanged for a slightly higher interest rate. Understanding these costs helps determine if refinancing is financially beneficial in the long run. Deal Street Capital is committed to reducing your loan costs to save you money. Talk to one of our refinancing experts today.

How long does it take to refinance a home mortgage?

The refinancing process typically takes 30-45 days from application to closing but in some cases we can close in as little as a few weeks. The timeline can vary depending on the lender, the complexity of your loan, and the documentation you provide. To streamline the process, ensure all financial records, such as income statements, tax returns, and current mortgage details, are readily available. Choosing Deal Street Capital to manage your refinance can expedite the process and get you money faster.