BRRRR Method Loans

Made Simple

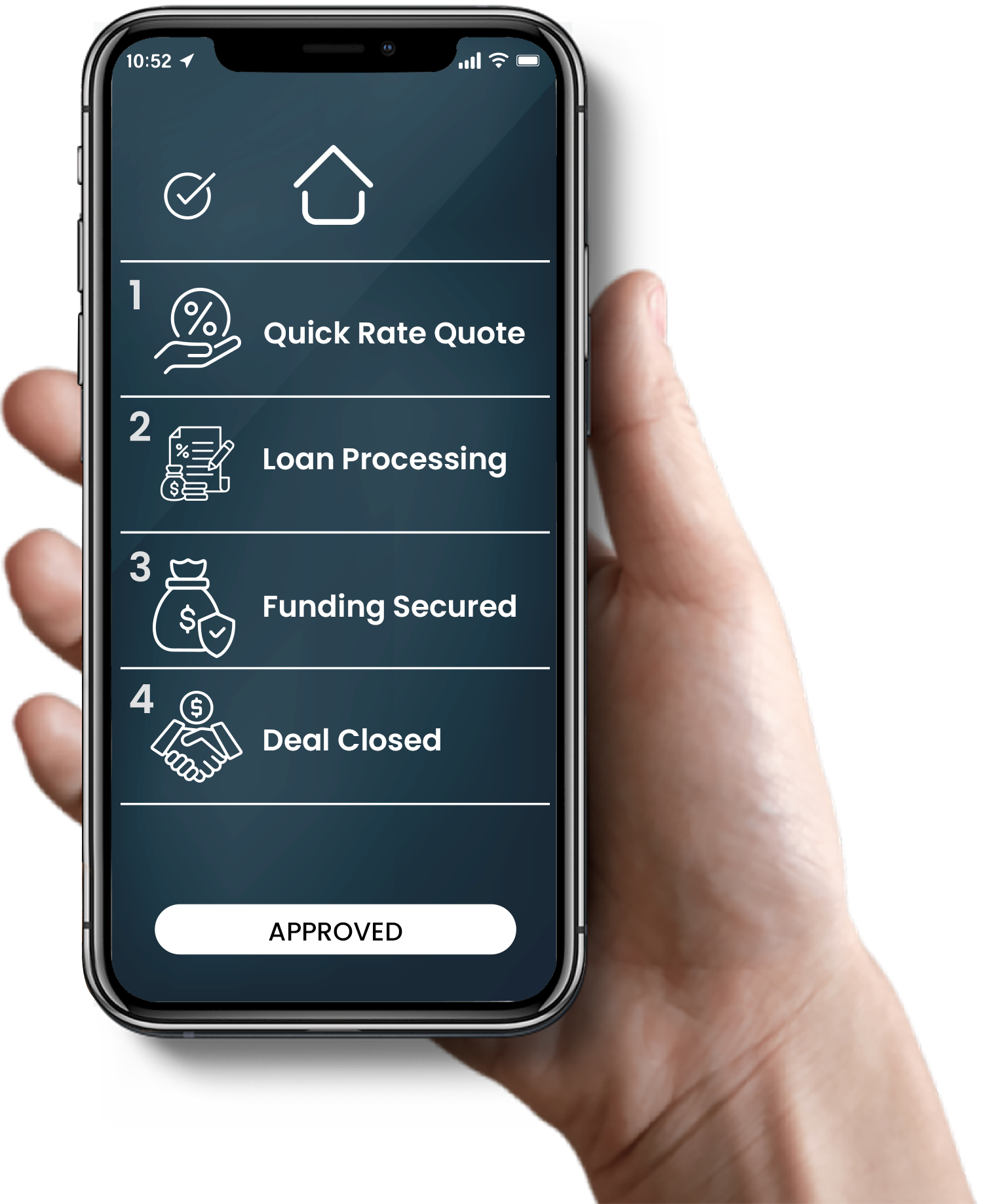

How to BRRRR

Step 1: Call Us

Before submitting an offer, give us a call. let one of our experts walk you through the process and provide you with a pre-approval letter.

Step 2: Buy

Due diligence is key. Use our Deal Calculators to analyze ROI, cash-on-cash returns, DSCR Loan ratios, rate/term, and payments.

Step 3: Rehab

Renovate strategically to boost the property’s value and appeal, maximizing its profitability and cash flow.

Step 4: Rent

Generate steady income by renting to reliable tenants and creating a cash-flowing asset.

Step 5: Refinance

Leverage the property’s increased value to pull out equity and position yourself for your next deal.

Step 6: Repeat

Use your equity to acquire new properties and grow your investment portfolio step by step.

Is the BRRRR Strategy Right For You?

Have questions about the BRRRR strategy? Below are answers to some of the most common questions.

What is the BRRRR method?

The BRRRR method involves buying, rehabbing, renting, refinancing, and repeating to grow a rental portfolio. Many investors using this strategy choose DSCR loans for financing, as they allow for faster portfolio scaling with minimal documentation—no income verification or W-2s required.

How do I finance a BRRRR property?

Typically, borrowers use fix-and-flip or bridge loans to fund the purchase, followed by a DSCR loan to refinance and pull cash out. Alternatively, investors can use cash to purchase the property and refinance later with a traditional full-doc investment home loan.

Is the BRRRR method risky?

To minimize risks with the BRRRR method, research markets with strong rental demand and appreciating values. Budget accurately, including purchase, renovation, and unexpected costs. Conduct professional inspections to uncover issues and use conservative ARV estimates to avoid overleveraging. Hire reputable contractors, screen tenants carefully, and maintain emergency reserves. Always plan for refinancing or selling to adapt to market changes. Proper planning and preparation are key to reducing risks and ensuring success.

Who is the BRRRR method for?

The BRRRR method is perfect for investors looking to build cash-flowing rental properties with minimal upfront capital. When executed correctly, it enables investors to scale their real estate portfolio by leveraging cash-out refinances to recover their initial down payment—and potentially even some profit—while focusing on growing a cash-flow-driven business. If you’re interested in learning more, give us a call at Deal Street Capital—we’re here to help you grow.