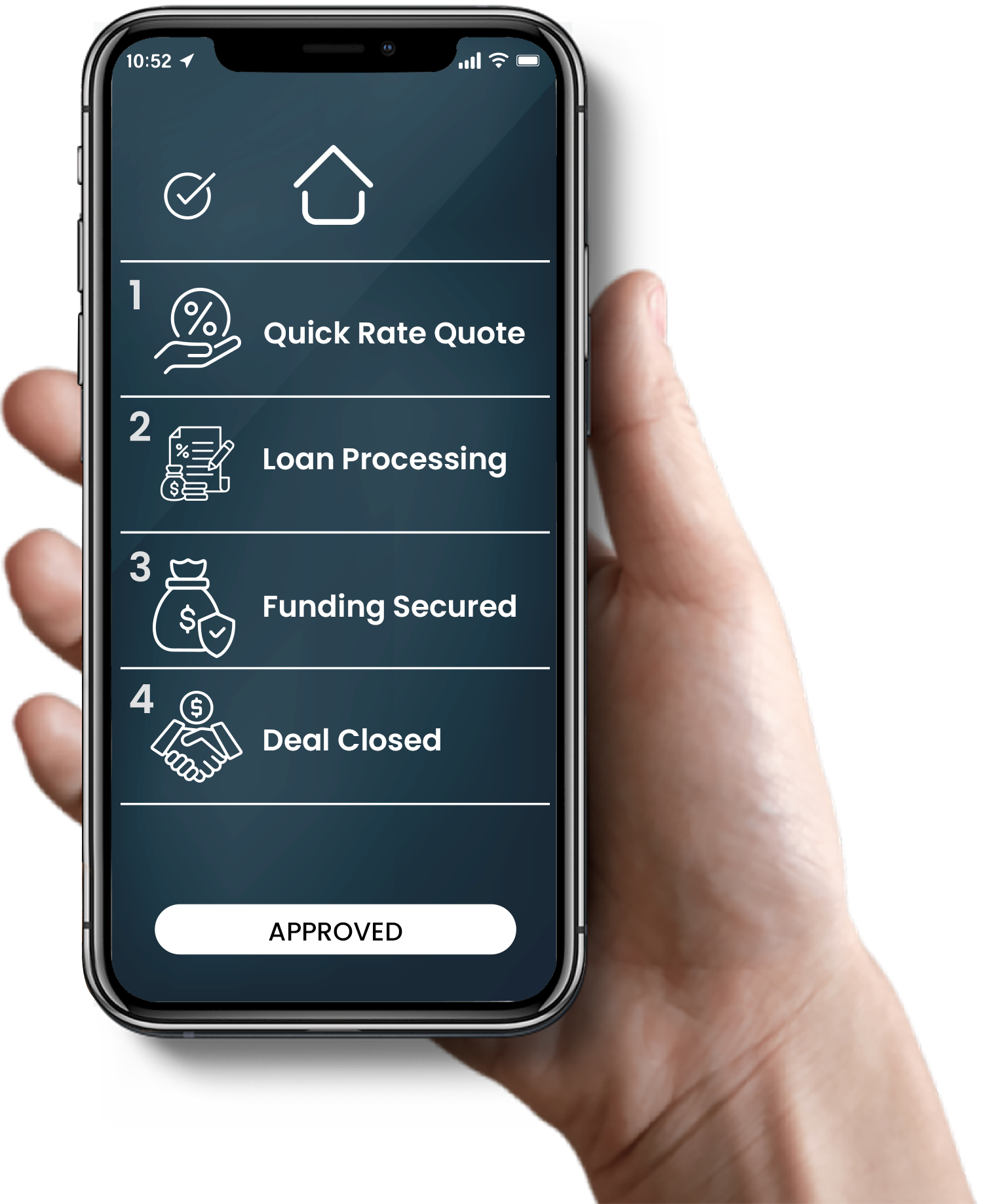

Rental Property Loans Made Simple

No income verification. No tax returns. Unlimited potential.

Fast flexible financing based on market rents for both short term and long term rentals. Enjoy industry low rates with an approval process that takes only minutes. When your lender understands investing, closing more deals isn’t luck, it’s what we do

Apply In Minutes

What does Lorem Ipsum text say?

Bring your brand to life with your own website.

Printers in the 1500s scrambled the words from Cicero’s “De Finibus Bonorum et Malorum” after mixing the words in each sentence. The familiar “lorem ipsum dolor sit amet” text emerged when 16th-century printers adapted Cicero’s original work, beginning with the phrase “dolor sit amet consectetur.”

They abbreviated “dolorem” (meaning “pain”) to “lorem,” which carries no meaning in Latin. “Ipsum” translates to “itself,” and the text frequently includes phrases such as “consectetur adipiscing elit” and “ut labore et dolore.”

Get Started

Join the Program: Fill out a quick form to register as a referral partner. It’s fast, free, and easy to get started.

Why It Matters: This ensures we have your information to track your referrals and pay commissions seamlessly.

Send Referrals

Share Your Leads: Send your referrals via email, and our CMS will ensure all client information is securely organized and tracked under your name in the system. Simply provide basic details such as the client’s name, contact information, and loan requirements

Why It Matters: The simpler the process, the faster we can connect with your referrals and close deals.

We Do the Work

We Handle the Financing: Our team takes care of the entire loan process, keeping your clients informed every step of the way.

Why It Matters: You can rest easy knowing your referrals are in expert hands while you focus on growing your network.

Get Paid

Earn Your Commission: Receive 25% of the loan commissions for every referral that closes. Plus, earn additional income on every future loan that client secures with us.

Why It Matters: Your earning potential is limitless, with passive income opportunities from repeat clients.

Our Fix-and-Flip Loans have no prepayment penalties, letting you pay off early and save money on every deal.

Whether you’re a seasoned investor or new to the game, our fix-and-flip loans are designed to let you pay off early and maximize your profits. Ready for your next project? Discover how our financing options can help you succeed.

Learn more!

Where We Lend

Your Next Investment Awaits – Click a Green State Below to Get Started!

We Lend in This State

Coming Soon…