Thinking about flipping your first property—or scaling up your real estate investment game? You’re not alone. Fix and flip projects are quickly gaining momentum again, and the numbers prove it.

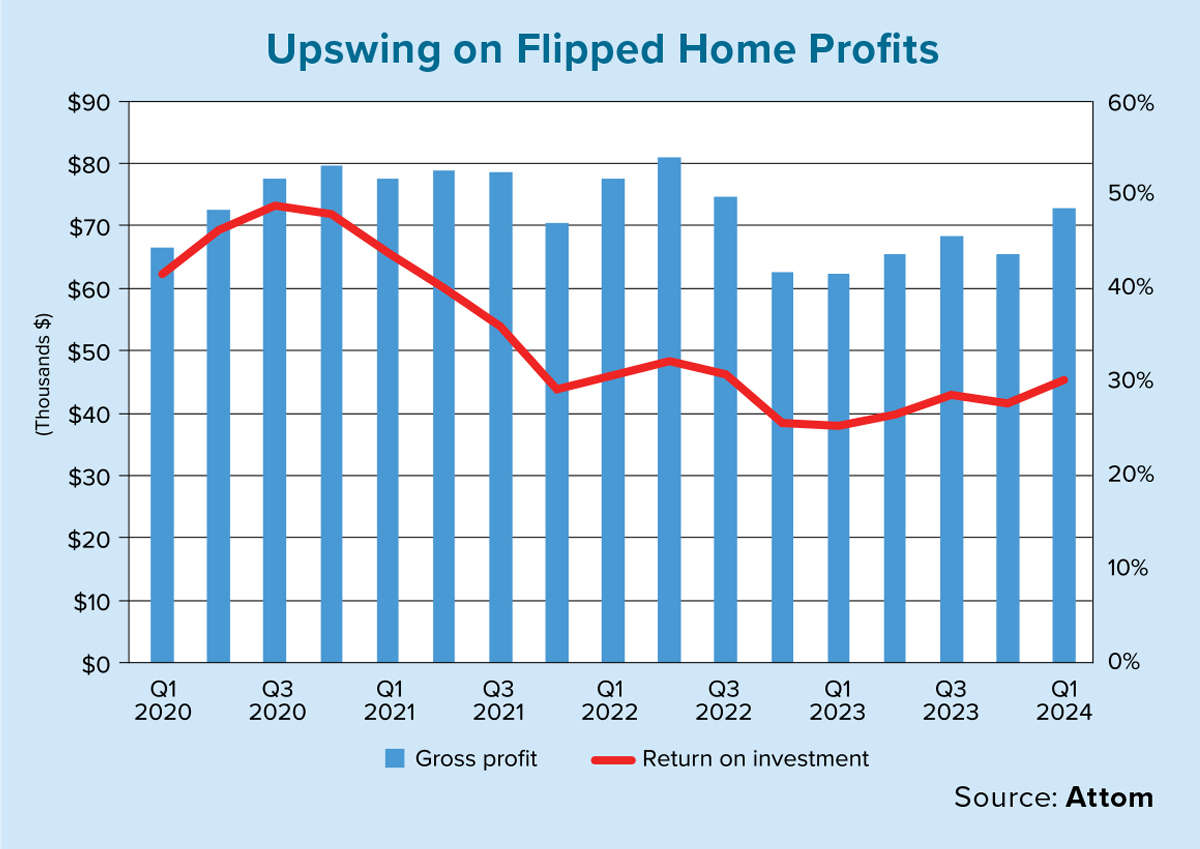

According to ATTOM’s Q1 2024 U.S. Home Flipping Report, 67,817 single-family homes and condos were flipped—making up 8.7% of all home sales. That’s up from 7.7% in Q4 2023, and it marks the second straight quarter of increased activity. Even better? Profits are rising too. The average gross profit before expenses jumped to 30.2% in Q1 2024, compared to just 25.3% the year prior. While still below 2016 peaks, this growth signals a potential turnaround in the fix-and-flip market (Scotsman Guide).

For real estate investors, that means new opportunity is knocking.

But before you grab a hammer or hire your contractor, you’ll need one key thing in place: financing.

That’s where fix-and-flip loans come in. In this post, we’ll break down what they are, how they work, and how Deal Street Capital makes the entire process easier, faster, and more investor-friendly.

What Are Fix and Flip Loans?

At Deal Street Capital, we specialize in fix-and-flip loans that are designed specifically for real estate investors who need speed, flexibility, and funding power. Whether you’re renovating a single-family home or turning a duplex into a modern rental, we help you close quickly and stay competitive.

So what exactly is a fix-and-flip loan? It’s short-term financing that helps you purchase and renovate a property to resell it for a profit. These loans are typically based on the property’s after-repair value (ARV) rather than your personal income or credit score. That means the better your deal looks on paper, the more funding you can secure.

Types of Fix and Flip Financing

Not all investors (or projects) are the same, which is why Deal Street Capital offers a range of financing solutions. Here’s a quick look at what’s available:

- Hard Money Loans – These short-term, asset-based loans are our most popular option. They’re fast and focus on the deal’s potential, not your credit history. Use our Hard Money Calculator to get an instant rate quote.

- Private Money Loans – Perfect for investors who want flexibility and are working with funding from individuals or private firms.

- HELOCs (Home Equity Lines of Credit) – Already own a home or investment property? A HELOC lets you tap into that equity.

- Cash-Out Refinance – Use the equity in an existing property to fund your next flip.

- Bridge Loans – Need short-term financing until a bigger loan kicks in? Bridge loans help you stay in motion.

You can learn more about each option on our loan programs page.

Key Loan Terms and Requirements

Let’s talk numbers. Every fix-and-flip loan has different terms, but here’s what you can generally expect:

- Loan-to-Value (LTV): Up to 85% of the purchase price or ARV.

- Interest Rates: Typically 8% to 12%

- Loan Terms: Usually 6–18 months

- Down Payment: Often 10%–20% of the property price

Want the full breakdown? Visit Deal Street Capital’s Loans for Investors page for a more detailed breakdown.

Benefits of Fix and Flip Loans

So why use a fix-and-flip loan instead of your cash or a traditional mortgage?

- Speed: Close deals fast in hot markets.

- Flexibility: Credit issues? No problem. These loans look at the deal itself.

- Leverage: Free up your cash to take on multiple projects.

Deal Street Capital helps you move quickly, with simple applications and transparent terms.

Things to Watch Out For

As with any investment strategy, there are a few things to keep in mind:

- Market Fluctuations: If the market dips, your profit might too.

- Renovation Delays: Timelines can shift—make sure your budget has wiggle room.

- Exit Strategy: Know exactly how you plan to sell or refinance before you close.

How to Apply for a Fix and Flip Loan

Getting started is easier than you might think. Here’s how it works:

- Gather Your Docs – We’ll want property details, a renovation plan, contractor bids, and a timeline.

- Apply – Submit your info online or talk to our team.

- Appraisal + Review – We’ll assess the property’s ARV and finalize terms.

- Close + Get Funded – We move fast so you can get to work.

Why Work with Deal Street Capital?

There are a lot of lenders out there. So why do investors choose us?

- We Know Real Estate – Fix and flip financing isn’t a side hustle—it’s our specialty.

- Fast Approvals – Timing is everything. We help you move quickly.

- Flexible Terms – We offer customized solutions, not cookie-cutter loans.

- Support from Start to Finish – Our team is here to guide you through every step.

You can read more about what makes us different on our About page.

Final Thoughts

Fix and flip loans are one of the most powerful tools in a real estate investor’s toolbox. With the right funding partner, you can turn neglected properties into profitable investments—again and again.

Ready to get started? Contact Deal Street Capital today to learn how we can help bring your next project to life.