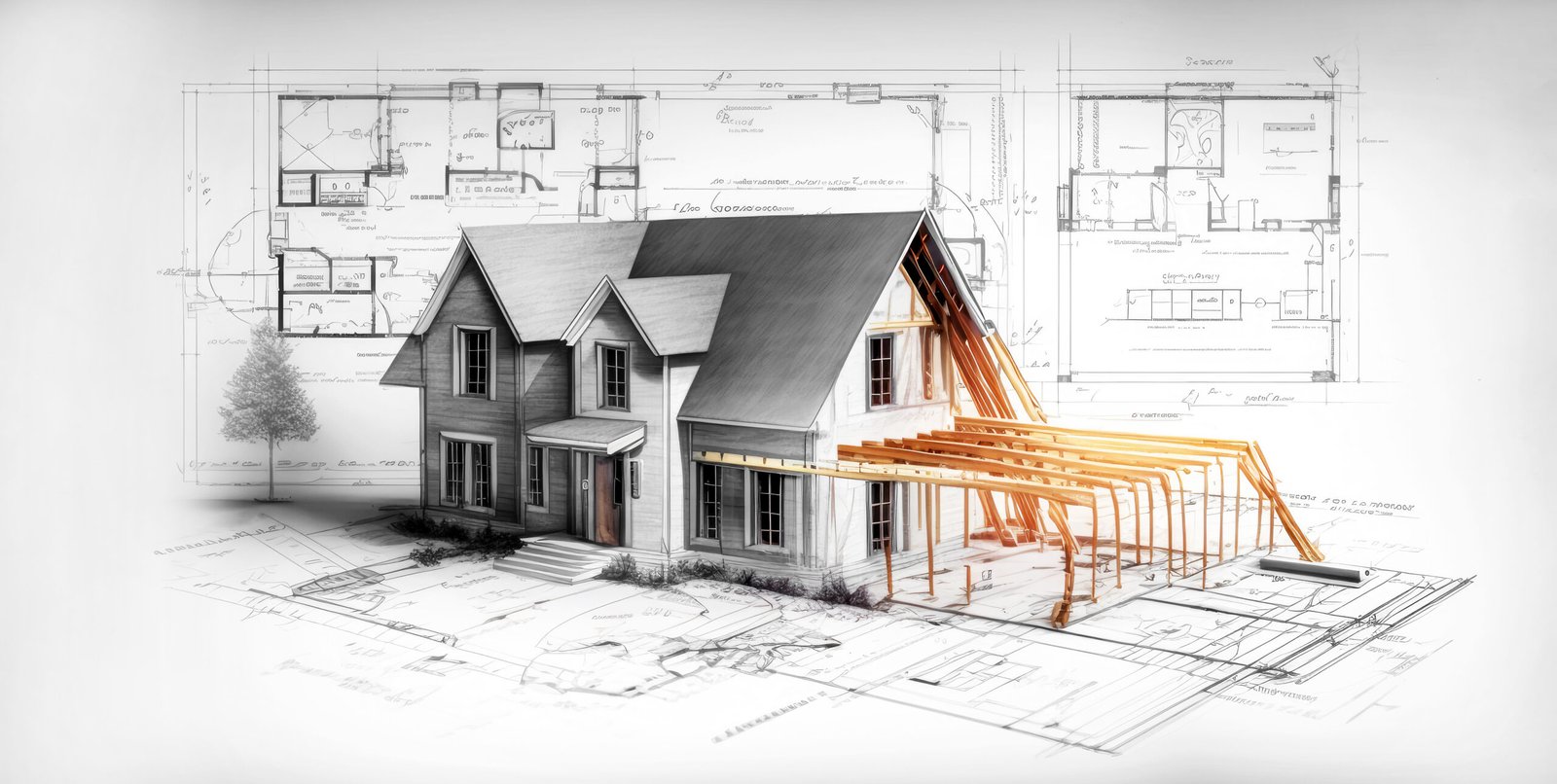

New Construction Loans

Made Simple

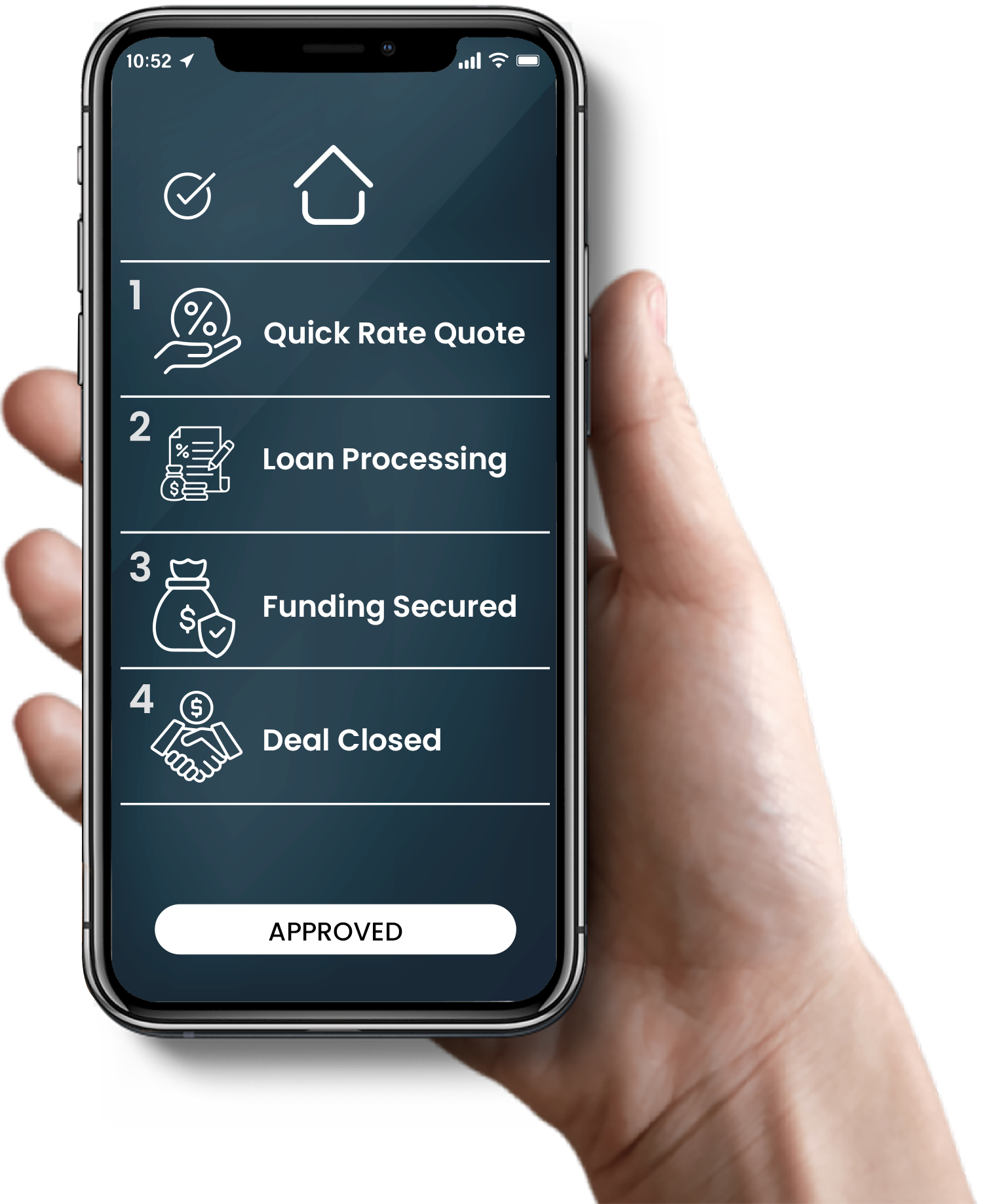

Close Fast

Our Team is dedicated to closing your deals as quickly as possible. Expedited Loans can be closed in as quickly as 72 hours.

High leverage

Up to 95% Loan-to-cost, 85% ARV, & 100% of renovation costs Covered. Scale your business by using our capital.

Competitive rates

Industry low rates and flexible terms. Our Investor Loyalty Program Offers significant discounts on loan costs.

Construction Financing Built for Developers

Have questions about New Construction Loans? Below are answers to some of the most common questions.

What is a new construction loan?

A new construction loan is short-term financing used to cover the costs of building a property from the ground up. Funds are released in stages as construction milestones are completed, ensuring the project stays on track. The four most common new construction loan types are construction-only loans, construction-to-permanent loans, hard money loans, and lot/land loans for property acquisition in combination with additional construction loans.

What is required to qualify for ground-up construction financing?

To qualify for ground-up construction financing, borrowers typically need a detailed construction plan, a licensed builder, and a comprehensive budget. Lenders often require a down payment, usually ranging from 10% to 30% of the project cost. While a strong credit score can enhance approval chances, some lenders may consider borrowers with lower scores, especially if other aspects of the project are solid. Additionally, demonstrating financial stability and sufficient reserves to cover unexpected expenses can strengthen your application.

Can I use a new construction loan for land?

Some new construction loans cover both land purchase and construction costs, while others require separate land financing. Give us a call to discuss your options and create a capital stack that works for you.

What happens after construction is complete?

Once construction is finished, borrowers can transition to a long-term mortgage or refinance to pay off the ground-up construction loan. This ensures long-term financial stability for the completed project. For any questions about new construction loans or refinancing, reach out to Deal Street Capital—we’re here to help guide you through every step of the process.